| Campaign optimizers | ROAS-based optimizers | Event-based optimizers |

|---|---|---|

Optimizers help advertisers fine-tune campaigns towards achieving specific goals. Let’s take a look at the two most common types of campaign optimizers. | IAP ROAS: In-app purchase ROAS campaigns optimize to acquire users more likely to make purchases in your app. Ad Revenue ROAS: Ad revenue ROAS campaigns optimize to acquire users who are more likely to engage with ads in your game. Hybrid ROAS: Hybrid ROAS campaigns optimize to target users who are more likely to make purchases in your app, engage with ads in your app, or do both. | Optimize your campaign to focus on finding high-value users that are likely to complete a specific in-app event in your game, such as completing a level or making an in-app purchase. There are many events to target, so we’ll take a look at the most common events later on in this report. |

| Campaign optimizers | ROAS-based optimizers | Event-based optimizers |

|---|---|---|

Optimizers help advertisers fine-tune campaigns towards achieving specific goals. Let’s take a look at the two most common types of campaign optimizers. | ||

| ROAS-based optimizers IAP ROAS: In-app purchase ROAS campaigns optimize to acquire users more likely to make purchases in your app. Ad Revenue ROAS: Ad revenue ROAS campaigns optimize to acquire users who are more likely to engage with ads in your game. Hybrid ROAS: Hybrid ROAS campaigns optimize to target users who are more likely to make purchases in your app, engage with ads in your app, or do both. | ||

| Event-based optimizers Optimize your campaign to focus on finding high-value users that are likely to complete a specific in-app event in your game, such as completing a level or making an in-app purchase. There are many events to target, so we’ll take a look at the most common events later on in this report. |

Ad revenue only

IAP and ad revenue

IAP revenue only

Breaking your game down into three main stages – early, mid, and late game – can help you map users to high-value rewards that will motivate them at their specific stage. Meet users where they are at to encourage game progression and provide relevant, engaging offers which can increase chances of repeat purchases.

Ad engagement

Ad depth

As people face economic challenges limiting their ability or readiness to pay for IAPs, ads become increasingly valuable, offering users an alternative way to access in-game content for game progression.

Action

Adventure

Arcade

Board

Card

Casino

Casual

Hypercasual

Puzzle

Racing

Role playing

Simulation

Sports

Strategy

Trivia

Word

Action

Adventure

Arcade

Board

Card

Casino

Casual

Hypercasual

Puzzle

Racing

Role playing

Simulation

Sports

Strategy

Trivia

Word

As we see in chart 3.4, providing rewards when a user is most likely to benefit from them can help drive deeper engagement. Ideally, developers should identify the baseline for their genre and then attempt to improve it.

Between levels

In IAP store

Lobby/Map/Pre-level

Pop-up message

Resource ran out

0 - 4

5 - 9

10 - 14

15 - 20

> 20

Make sure you’re providing users with a variety of different rewarded video formats (short, long, small, larger rewards) to keep things interesting. You can always A/B test to see what users are most responsive to.

Additional moves

Multiplier

Hint

Daily reward

Quest/Milestone

Timer reduction

Entry ticket

Lives/Health/Energy

Retry after fail

Gacha

Consumable/Power Ups

Nonconsumable/Cosmetic Items

Offline earn progress

Currencies

Additional reward

Bidding

Add/Remove specific ad network(s)

Country-specific pricing optimization

Waterfall optimization

Refresh rate

Latency

IDFA (Identifier for advertisers)

Impression capping

COPPA (Children's Online Privacy Protection Act)

Offerwall

Rewarded video/Interstitial

Offerwall

Rewarded video/Interstitial

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

Achieve level

Complete mission/event/task

Make in-app purchase

Complete tutorial

Sink/source certain amount of resources

Engage with multiplayer features

Invite friends

Complete tutorial

Achieve level

Engage with multiplayer features

Complete mission/event/task

Sink/source certain amount of resources

Invite friends

Make in-app purchase

1. Engage in reward-based progression

Offers that involve between 7 and 10 steps are especially popular among offerwall users.

2. Implement time-bound steps

Advertisers are gravitating toward step types that encourage reaching a certain level within a limited time frame.

3. Integrate lower-friction tasks

Tasks that have lower friction like completing a tutorial or level have higher conversion rates.

4. Mix event types

To maximize scale, a mix of event types will enable you to optimize your spend and reach.

1

2

3

4

5

Their limited time frame encourages users to quickly complete an offer in order to take advantage of these higher rewards, which can lead to an increase in conversions by as much as 46% during the sale²⁵.

1. Make your messaging clear and compelling

The wording used on offerwall entry points can directly impact whether users engage. Entry points with the word “free” have higher open rates.

2. Prominent offerwall placements

Prominent placement of offerwall in main UI screens serves as a reminder of available offers and can lead to increased visibility, higher open rates, and stronger engagement.

3. Improve discoverability with pop-ups

Pop-ups also enhance offerwall discoverability, reminding users of rewards they can earn and directing them to engagement opportunities.

4. Implement currency sales

Special promotions encourage new users to engage with offers they may have originally dismissed, generating periodic revenue spikes throughout the year.

Unity (NYSE: U) is the world's leading platform of tools for creators to build and grow real-time games, apps, and experiences across multiple platforms, from mobile, PC, and console, to spatial computing. For more information, visit Unity.com.

For more information about Unity Grow, visit unity.com/grow.

Forward-Looking Statements

This publication contains “forward-looking statements,” as that term is defined under federal securities laws, including, in particular, statements about Unity's plans, strategies and objectives. The words “believe,” “may,” “will,” “estimate,” “continue,” “intend,” “expect,” “plan,” “project,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to risks, uncertainties, and assumptions. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Further information on these and additional risks that could affect Unity’s results is included in our filings with the Securities and Exchange Commission (SEC) which are available on the Unity Investor Relations website. Statements herein speak only as of the date of this release, and Unity assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this publication except as required by law.

The data in this report is drawn from the Unity Cloud, Unity Ads, Tapjoy, and ironSource as data sources, including games made with Unity that are sending events through the platform.

We take data privacy seriously and have omitted and anonymized information from this report that would individually identify any single game, developer, or publisher. Games are broken out into publicly available categories as defined on the iOS and Google Play stores where available. Although we also include outside sources of information, the data shown in the charts and graphics is original to Unity. In addition, we are grateful to those members of the industry whom we interviewed for this report, many of whose contributions are quoted throughout.

Tier 1 (T1): Includes the U.S., Canada, Australia, and Great Britain. These are countries with considerable purchasing power.

Tier 2 (T2): Includes Denmark, Sweden, Norway, Finland, and Ireland. These countries have very high levels of English comprehension but slightly less purchasing power than T1.

Rest of world (RoW): Includes countries not listed as T1 or T2.

Global: Includes all countries across T1, T2, and RoW.

¹[Source: Unity Ads network, ironSource Ad network] [Disclaimer: Gaming only, CPI]

²[Source: Unity Ads data in 2023] [Disclaimer: Campaigns with over $100 USD spent in the year.]

³[Source: Unity Ads demand supply internal] [Disclaimer: United States, gaming only, May 1 to May 31, 2024]

⁴[Source: Unity Ads demand supply internal] [Disclaimer: Playable only, data as of May 1 to May 31, 2024]

⁵[Source: Unity IAP Plug-in] [Disclaimer: Games that made over $10k USD in 2023, players that installed in 2023]

⁶[Source: Unity IAP Plug-in] [Disclaimer: Games that had made over $60k USD in IAP revenue in 2023, players who installed in 2023]

⁷[Source: Unity] [Disclaimer: Games with over $300 USD monthly revenue from rewarded video, with over 1,000 average DAU]

⁸[Source: LevelPlay] [Disclaimer: Games with over 150k installs in 2022, over 3,000 players in a country]

⁹[Source: LevelPlay] [Disclaimer: Games with over 1,000 DAU and $100 USD daily total mediated ad revenue]

¹⁰[Source: Unity LevelPlay] [Disclaimer: Games with over 1,000 DAU and $100 USD daily total mediated ad revenue]

¹¹[Source: Unity LevelPlay] [Disclaimer: Games with over 5,000 DAU and $50 daily total mediated RV revenue]

¹²[Source: Unity LevelPlay] [Disclaimer: Games with over 5,000 DAU and $50 daily total mediated RV revenue]

¹³[Source: Unity LevelPlay] [Disclaimer: Games with over 5,000 DAU and $50 daily total mediated RV revenue]

¹⁴[Source: Unity LevelPlay]

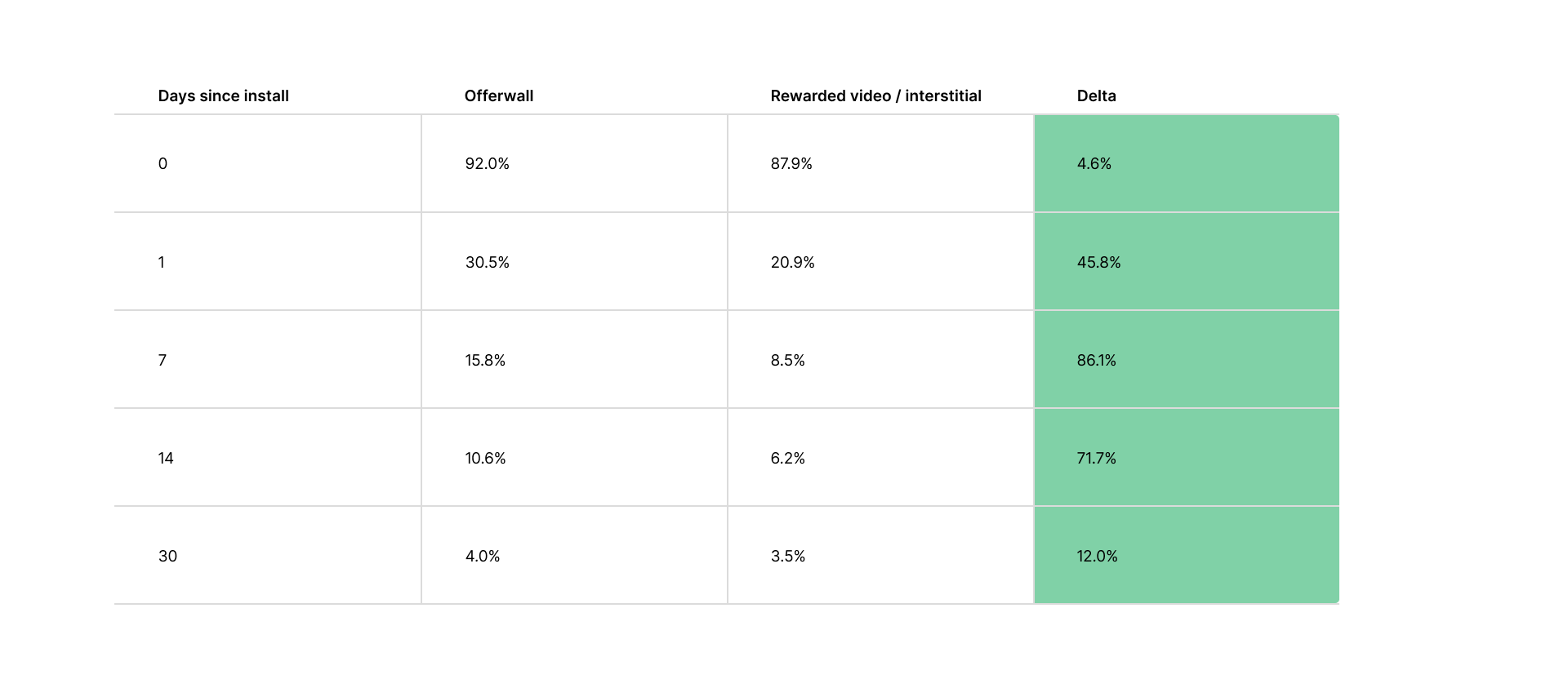

¹⁵[Source: Tapjoy, Unity ironSource] [Disclaimer: Apps with at least $5,000 USD monthly offerwall UA spend; Apps with at least $10,000 USD monthly ad RV and INT UA spend]

¹⁶[Source: Tapjoy, Unity ironSource] [Disclaimer: Apps with at least $5,000 USD monthly offerwall UA spend; Apps with at least $10,000 USD monthly ad RV and INT UA spend]

¹⁷[Source: Tapjoy] [Disclaimer: Apps with at least 10 offer conversions in year 2023]

¹⁸[Source: Tapjoy] [Disclaimer: Apps with at least 10 offer conversions in year 2023]

¹⁹[Source: Tapjoy] [Disclaimer: Apps with at least 10 offer conversions in year 2023]

²⁰[Source: Tapjoy] [Disclaimer: Apps with at least 10 offer conversions in year 2023]

²¹[Source: Unity IAP Plug-in, Unity LevelPlay, Tapjoy] [Disclaimer: Apps with at least $1,000 USD monthly offerwall revenue; at least 1,000 DAU; at least $1,000 USD monthly RV revenue; at least $1,000 USD monthly IAP revenue]

²²[Source: Tapjoy] [Disclaimer: Apps with at least $500 quarterly offerwall revenue in 2023]

²³[Source: Tapjoy] [Disclaimer: Apps with at least $500 quarterly offerwall revenue in 2023]

²⁴[Source: Tapjoy] [Disclaimer: Apps with at least $500 quarterly offerwall revenue in 2023]

²⁵[Source: Tapjoy] [Disclaimer: Data from January 2023 through November 2023]

²⁶[Source: Tapjoy] [Disclaimer: Apps with at least a single offer conversion in year 2023]

Fill out this form to access the 2024 Mobile Growth and Monetization Report